free cash flow yield explained

In YouTube video Accounting teacher Susan has explained following 4 cash flow ratioOne cash flow ratio I have. Free Cash Flow Yield The Best Fundamental Indicator This model uses scarcity to quantify the value of bitcoin but it can also be applied to other assets like gold.

R Tutorial The Free Cash Flow To Equity Model Youtube

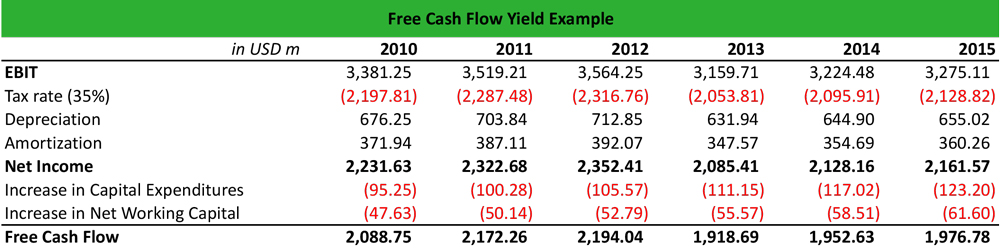

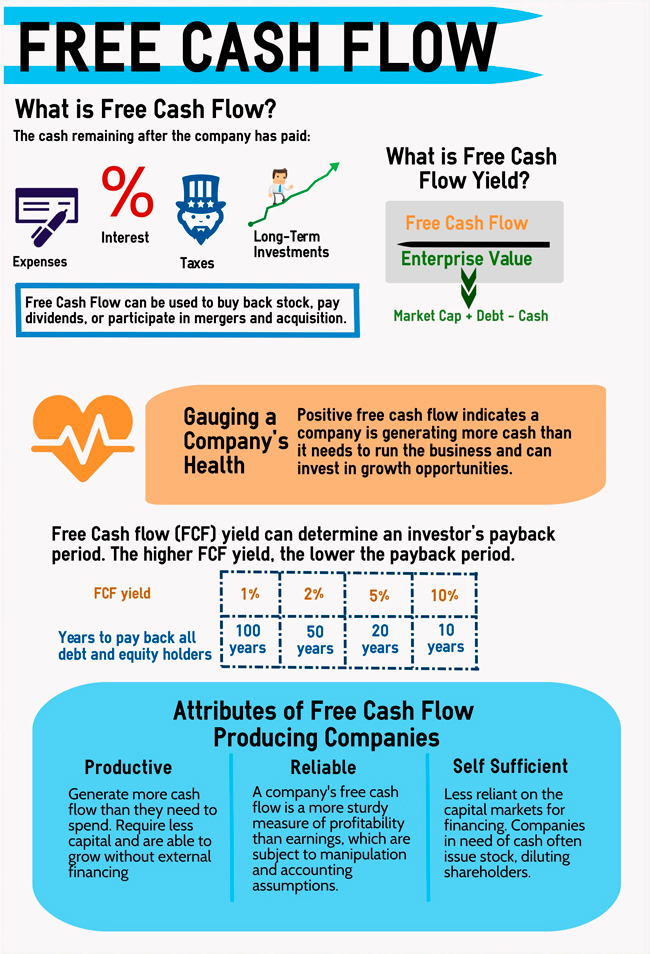

The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share.

. Free cash flow FCF is the money a company has left over after paying its operating expenses OpEx and capital expenditures CapEx. Free Cash Flow Yield Free Cash Flow Market Capitalization. It doesnt include the.

This metric is very similar to the. Cash flow is vital because if a business runs out of. Free Cash Flow Yield.

In this weeks short video. The Free Cash Flow Yield is an overall return evaluation ratio of a stock determining the FCF per share a company is expected to earn against its market price per share. Free Cash Flow Explained.

Key Takeaways A higher free cash flow yield is ideal because it means a company has. I dont find Net Free Cash Flow used too much possibly. Httpsamznto35cbAn0Favorite Wealth Building Book.

Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment. The ratio is calculated. Free cash flow is the cash that a business has available to pay debts buy assets such as stock or property or pay shareholders dividends and interest.

The more free cash flow a company has. For cash flow 1. Cash may be King but FCF yield is an Ace.

People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate. Net Free Cash Flow NFCF Free Cash Flow FCF current portion of long term debt current portion of future dividends 1 year. In this weeks short video I explain how it.

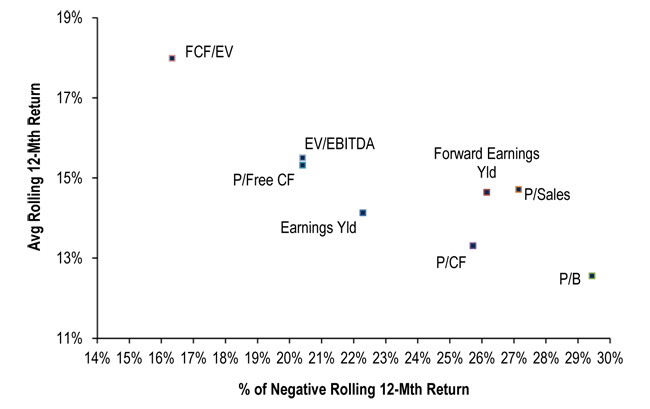

Free cash flow FCF is the cash a company produces through its operations after subtracting any outlays of cash for investment in fixed assets like property plant and. The free cash flow FCF yield is a way to decide whether a firm is cheap or expensive based on its cash flows rather than say its earnings. Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive.

Price to free cash flow is an equity valuation metric used to compare a companys per share market price to its per share amount of free cash flow. Terry Smith Book. Thats the ratio of free cash flow to market cap.

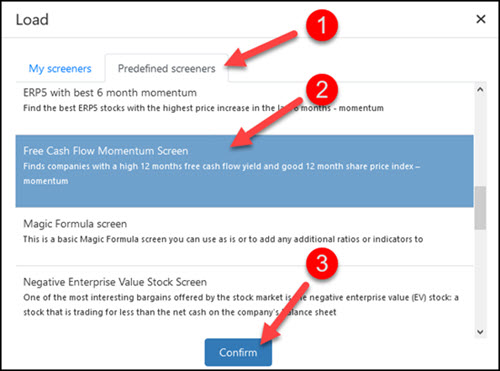

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Defining A Good Fcf Margin Formula Basics Examples And Analysis

All Cap Analysis Free Cash Flow Yield Falls In 2020

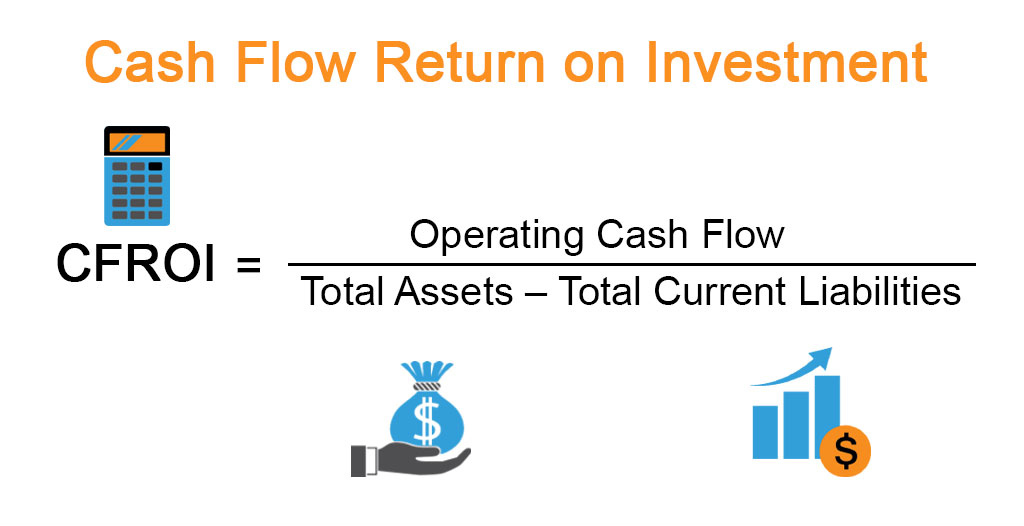

Cash Flow Return On Investment Examples With Excel Template

The Power Of Free Cash Flow Yield Pacer Etfs

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

What Is Free Cash Flow Yield Definition Meaning Example

Unlevered Free Cash Flow Definition Examples Formula

All Cap Analysis Free Cash Flow Yield Falls In 2020

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Solved Question 11 9 1 Points Which Of The Following Chegg Com

Free Cash Flow Yield Formula And Calculator

The Power Of Free Cash Flow Yield Pacer Etfs

Refreshing Revenue The Cash Conversion Cycle And Free Cash Flow Cfa Institute Enterprising Investor